You're writing down the things you see and do. You're writing down how you felt as you said and did these things. You're interviewing other people in this group to see how they felt as they said and did the things. You're maybe throwing in a bit of history, where that context is relevant. And overall, most importantly, you're making connections between the different parts of the culture, drawing connections, identifying contradictions, and ultimately saying, "Hmm, well this makes a lot of sense," or maybe, "Hmm, this actually doesn't make that much sense to me."

It's a cool way to kind of tell the story of a social group. You could write an ethnography about your college, an ethnography about your hometown, a ethnography of your lacrosse team, an ethnography of whatever. In this case, the author, Karen Ho, is trying to write an ethnography about Wall Street. She got a job as an employee at an investment bank on Wall Street, and, with their consent, she began writing down what she saw, finding connections and themes in the behaviors she was observing, and ultimately trying to decide whether Wall Street does or does not make sense, from her perspective.

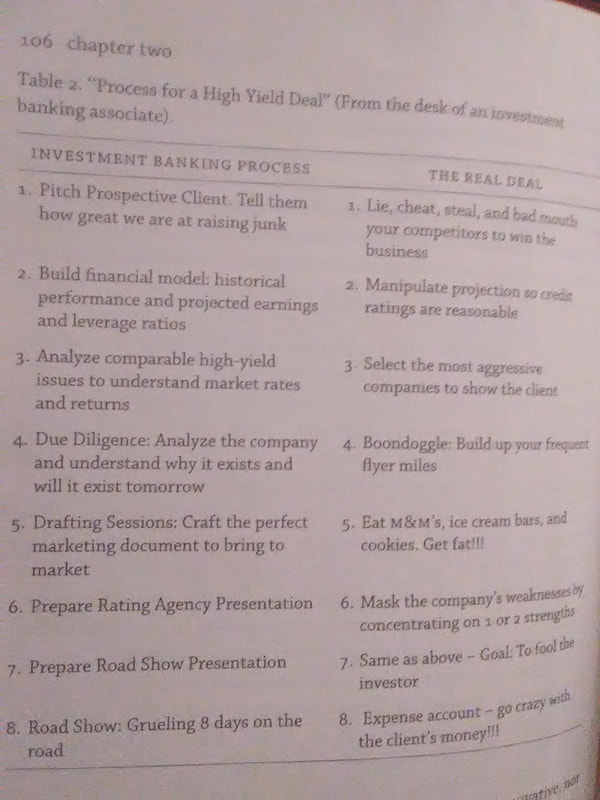

Her most memorable argument was the idea that many investment banking analysts are actually producing BS work, not real financial analysis. She includes, for example, the chart that I've copied here to this article, comparing the correct technical way to build a financial model and the actual way that she observed investment banking analysts producing models--as lazily and sloppily as possible. She writes:

"While investment bankers certainly recognize that they do, in fact, bullshit their clients, they usually view such practices as justified by the hard work they genuinely put in, their superior knowledge of the market, and the financial good they are sure their interventions ultimately accomplish."

Having never actually worked on Wall Street, it's difficult for me to agree or disagree with her statement about whether the work investment bankers do is actually BS. There's a big finance meme culture on Instagram and other social media forums, where you can see people making fun of the BS work that investment banking interns do seem to produce during their summer internship. But the general idea there is that it's only the interns, greenies, newbies who are doing the BS. The people making fun of them are the established associates, vice presidents, etc., who are actually producing real work and often correcting the mistakes and the BS that they observe the analysts putting forth.

I would guess that Ms. Ho is of a left-leaning orientation. Her critique of Wall Street seems to be that, in contrast to Main Street, where people work 9 to 5, and put in a good, honest day of labor, Wall Street seems to be a place where BS, covered by elitism and fancy college degrees, passes for hard work and justifies a sense of cultural condescension toward Main Street American middle-class workers.

How do I feel about this? Well I think Ms. Ho is mistaken. I think that finance is real, hard work, as I'm learning in my Georgetown finance program, and as anyone who tries to number-crunch a financial statement also knows. I think the best way to understand the financial world is not through a qualitative analytic method, like ethnography, but rather by quantitative methods, like getting in there and learning how to produce a multi-tab Excel spreadsheet valuation analysis, the same way Wall Street analysts might do.

Once you get in there and learn how to work with the numbers as a financial analyst, I think you might have a little more respect for Wall Street and its parallels in other cities, and I think you might be a little more inclined to say that finance industry professionals do actually deserve to get paid the kinds of salaries they do. Finance is hard work.

I can't pretend that I'm not haunted, sometimes, by the ghost of Karen's whisper, her suggestion that everything I might possibly do in my finance career is BS. Some finance roles and projects do seem more intellectually intense than others, and some roles and projects do seem closer on the spectrum to BS. But at the end of the day, I reject her claim that finance altogether is a BS industry, and I would argue pretty confidently that finance is just as hard or as valid of an industry as anything else anybody might choose to do.

RSS Feed

RSS Feed